Marketing

Dec 24, 2025

The Digital Banking Revolution: Why Your Marketing Strategy Needs an Upgrade

Digital marketing solutions for banks are no longer optional; they are essential. To compete and grow, modern banks need:

Data-driven personalization using AI and first-party data for targeted offers.

Content marketing and SEO to build trust and improve search visibility.

Omnichannel engagement across mobile apps, social media, email, and websites.

Performance-based advertising with geo-targeting and remarketing.

Robust analytics to measure ROI while ensuring regulatory compliance.

The numbers are clear: digital sales could account for 40% of new bank revenue within 5 years. Already, 90% of mortgage and loan consumers start their journey online, yet many banks still take over 14 weeks to launch a digital campaign.

Branch-focused marketing is fading. Customers now expect the speed and personalization they get from Amazon or Netflix. With 81% of the U.S. population on social media and 84% searching online for new products, potential customers are researching financial institutions right now.

Banking is different from other industries. You are asking for trust with people’s futures, so you must balance digital speed with safety and strict regulations.

The competitive landscape has shifted. Digital-native fintechs deliver seamless experiences and are gaining market share. Unburdened by legacy systems, they are built for the digital age.

The good news: banks investing in modern digital marketing see strong results. Agile marketing can reduce campaign cycles by 60–80%, personalization can generate up to 40% more revenue, and AI-powered automation has driven 15–25% revenue lifts in early tests.

I'm Ross Plumer, and I've helped businesses market over $20 million in revenue by developing digital marketing solutions for banks that align innovation with regulatory needs. My approach uses psychology and customer behavior research to craft strategies that resonate and deliver measurable results.

The Core Pillars of Digital Marketing Solutions for Banks

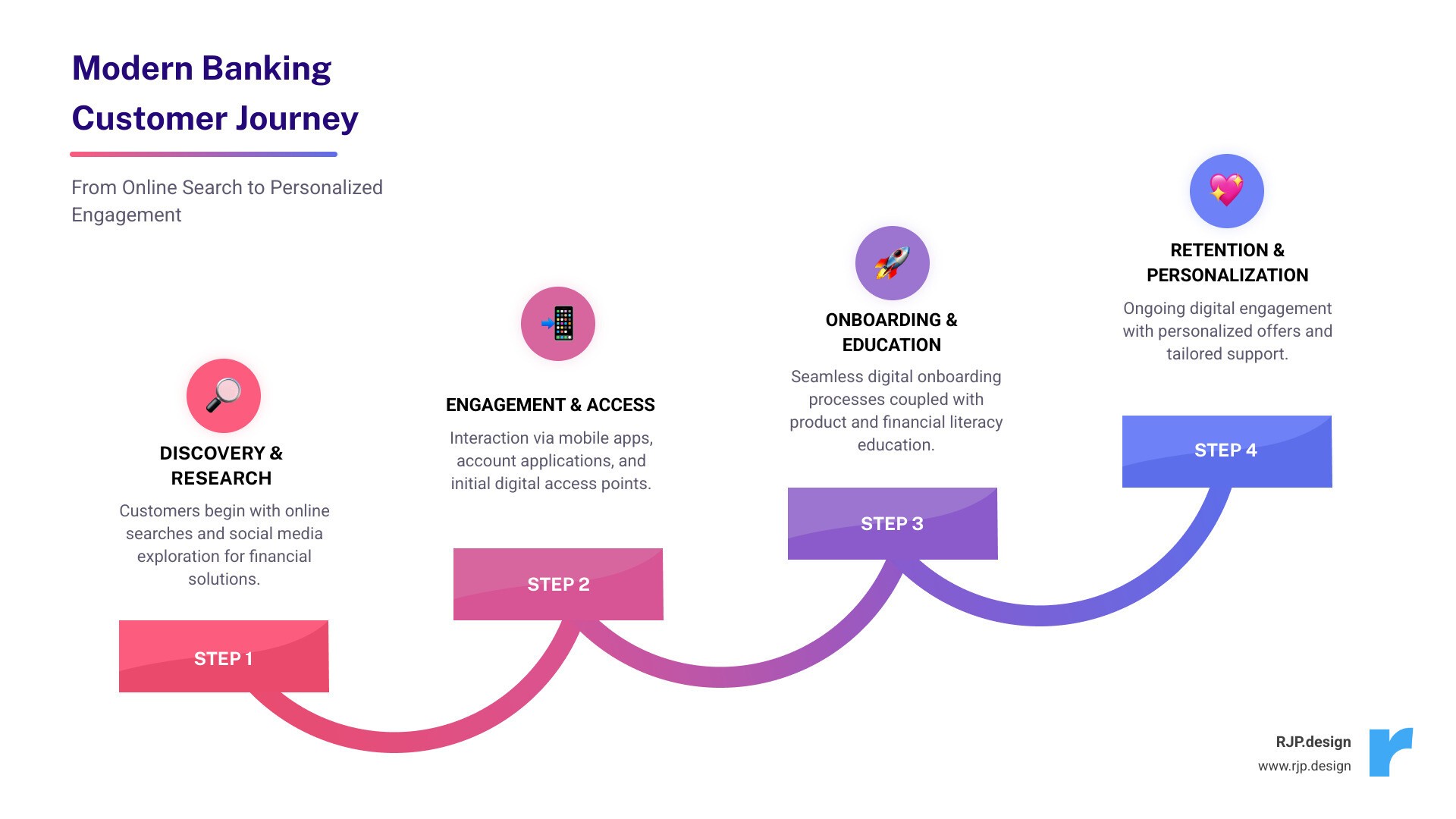

Successful banking marketing is like a symphony: every channel should work in harmony. An omnichannel approach ensures each touchpoint, from your website to your mobile app, creates a seamless experience. Winning today requires real integration across product, IT, and marketing—not just a checklist.

Customers think in experiences, not channels. They might research a mortgage on a laptop, check their balance on a phone, and message you on social media. Each interaction should feel like one continuous, trusted conversation. At Digital Marketing Strategies, we help you build that seamless, trust-building journey.

Using Data, AI, and Personalization

Your bank already has valuable customer data; the opportunity is using it well. Modern digital marketing solutions for banks connect real-time data to machine learning platforms to predict needs and deliver relevant offers.

Demand is rising: 53% of Gen Z and Millennials want more personalized banking—similar to Netflix or Amazon. Banks like Scotiabank and KeyBank are using AI to deliver custom experiences. AI-powered automation also improves ad bidding and A/B testing, saving time and reducing costs.

As third-party cookies disappear, first-party data becomes critical. Data collected directly from customers helps you segment audiences, anticipate needs, and create campaigns that convert. Many institutions see 15–25% revenue lifts with this approach. Learn how we support your Business Growth Online.

Building Trust with Content and SEO

Trust starts with visibility. With 90% of mortgage and loan consumers searching online first, you must be present during research—and you must be credible. Content marketing and SEO work together to achieve both.

Examples include The Bank of Colorado’s resource center with financial tips and the European Bank for Reconstruction and Development’s reports on sustainable development. These are useful resources that build authority.

Google treats financial content as “Your Money or Your Life” (YMYL), applying strict E-A-T (Expertise, Authoritativeness, Trustworthiness) standards. We ensure your content is accurate, expert-led, and genuinely helpful. This builds authority, drives traffic, and converts visitors into confident customers. Explore our Digital Marketing and SEO Services.

Omnichannel Engagement: From Mobile to Social

Your customers are everywhere online, and your brand should be too. An effective omnichannel strategy engages them across mobile, social, email, and web with a consistent experience.

Mobile banking apps are now must-haves. They streamline onboarding, deepen loyalty, and serve as powerful acquisition channels. A secure, feature-rich app is essential, and the development of mobile banking is foundational to modern strategy.

Social media can be challenging—organic reach is limited—but 44% of Gen Z and Millennials use it for financial advice. A thoughtful presence lets you host Q&As, share financial literacy content, and build relationships. Our Social Media Services can help you steer this space. Email marketing still delivers with a 38:1 ROI, and video on YouTube and TikTok is a strong way to reach younger audiences.

Effective Advertising and PPC Campaigns

Marketing financial products requires clarity and empathy. PPC delivers immediate visibility and precise targeting but comes with unique considerations:

Pros of PPC Advertising for Banks | Cons of PPC Advertising for Banks |

|---|---|

Instant Visibility: Appear at the top of search results immediately. | High Competition & Cost: Financial keywords are among the most expensive. |

Highly Targeted: Reach specific demographics, interests, or search intent. | Short-Term Strategy: Results stop when campaigns end, unlike SEO. |

Measurable ROI: Track every click, impression, and conversion for clear performance data. | Compliance Restrictions: Strict regulatory guidelines from platforms like Google. |

Flexibility: Easily adjust budgets, bids, and ad copy in real-time. | Ad Fatigue: Users can become desensitized to repetitive ads. |

Brand Awareness: Increase brand visibility even if users don't click. | Requires Expertise: Poorly managed campaigns can quickly drain budgets. |

Digital ad spend is rising—up 8.9% per the CMO Spring 2024 survey—driven by programmatic and Connected TV. We use geo-targeting and remarketing to reach the right people at the right time. Every campaign aligns with Google's advertising policies for financial services. Our expertise as a PPC Management Services Company ensures your campaigns are effective and compliant.

Measuring Success and Ensuring Compliance

You improve what you measure. Strong analytics are the foundation of effective digital marketing solutions for banks. We track customer acquisition cost, lifetime value, conversion rates, and overall Return on Ad Spend.

Engagement metrics—like website dwell time and app usage—reveal how well your experience works. Continuous testing matters; quarterly experiments aren’t enough. Our Website Traffic Analysis helps you build a culture of ongoing optimization.

Compliance is non-negotiable. Every campaign must adhere to regulations like GDPR and fair lending laws. AI can assist by automating compliance monitoring and flagging risks early. We partner with you to ensure all marketing is both effective and compliant, protecting your reputation and customer trust.

Partnering for Growth: Building Your Future-Proof Strategy

The digital banking revolution is accelerating. From helping market over $20 million in revenue, I’ve seen that the banks that thrive are the ones that adapt quickly.

Your customers are online—researching on their phones and seeking advice on social media—while fintechs gain ground with seamless experiences. You don’t have to steer this alone.

Building a future-proof digital marketing strategy is customer-centric, data-driven, and agile. Invest in AI to understand needs, publish educational content that earns trust, and maintain a consistent presence across channels. The payoff is proven: agile marketing shortens campaign cycles by 60–80%, and personalization can boost revenue by up to 40%.

At RJP.design, we craft digital marketing solutions for banks that meet these demands. We understand regulations and the importance of trust. We combine web design, SEO, and digital strategy with deep knowledge of financial customers. Our approach to Digital Presence Enhancement ensures your bank doesn’t just look modern—it works like a modern digital business.

What sets us apart is our commitment to quality and a down-to-earth team that prioritizes long-term growth over quick wins.

Incremental changes aren’t enough. The banks that lead tomorrow are investing today in their digital presence, new technology, and customer experience.

Ready to transform how your bank shows up online? Let’s build something remarkable together. Whether you need an overall strategy or want to start by elevating your social media, we’re here to help. Let's build your social media presence together and create a digital marketing strategy that positions your bank for sustainable growth in the digital age.